When you switch health plans, your prescription drug costs can change overnight - even if you’re taking the same medication. Many people assume all generic drugs are treated the same across plans, but that’s not true. One plan might charge you $3 for your blood pressure pill. Another might hit you with a $40 copay or make you pay the full cost until you hit a $1,000 deductible. The difference isn’t the drug - it’s the formulary.

What Is a Formulary, and Why Does It Matter?

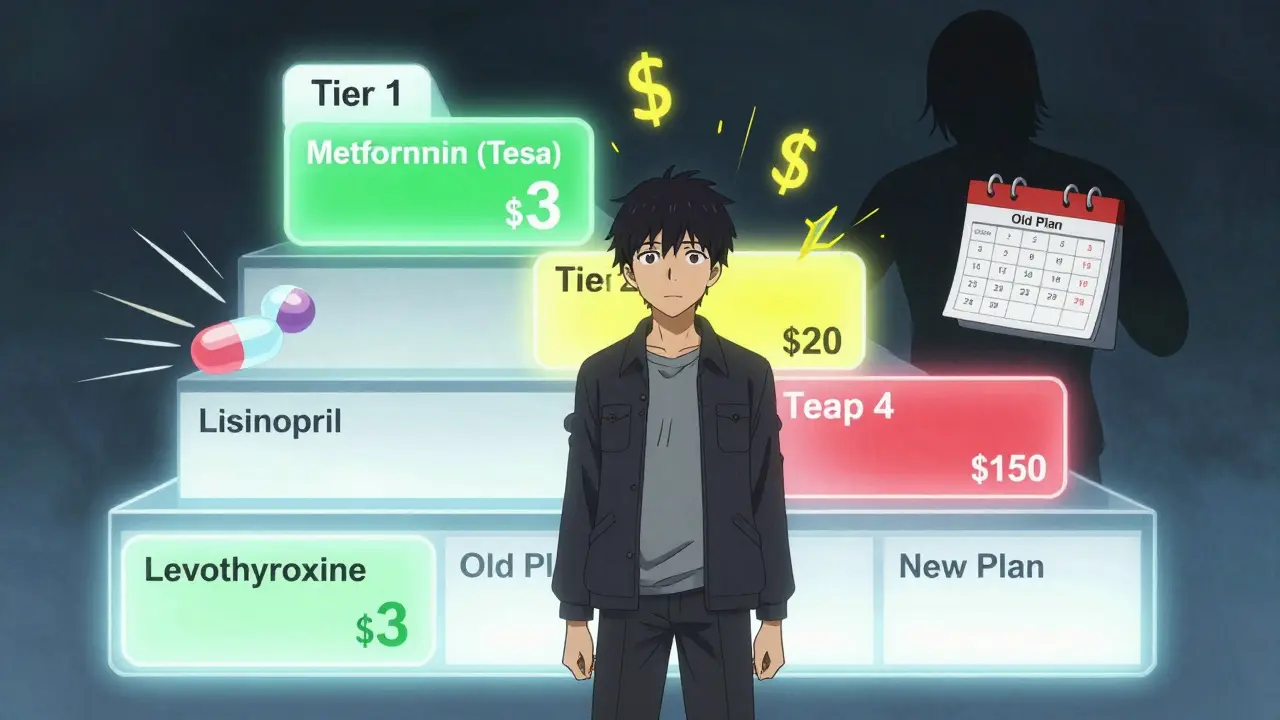

A formulary is a list of drugs your health plan covers. It’s not just a catalog. It’s a pricing structure. Most plans divide drugs into tiers, and each tier has a different cost to you. Tier 1 is almost always reserved for generic drugs. That’s where you want to be. In 2023, 92% of private health plans used a 3- to 5-tier system. Medicare Part D plans and marketplace plans follow similar rules. But here’s the catch: not all Tier 1 drugs cost the same. Some plans charge $3. Others charge $20. And some don’t cover generics until you’ve paid your entire medical deductible - which could be $2,000 or more. The Affordable Care Act made this clearer. Since 2014, marketplace plans must use a 4-tier formulary. Tier 1 = generics. Tier 2 = preferred brand-name drugs. Tier 3 = non-preferred brands. Tier 4 = specialty drugs. But even within that structure, plans vary wildly in how they apply deductibles and copays.How Much Can You Really Save on Generics?

Generic drugs make up 90% of all prescriptions filled in the U.S. But they only account for 23% of total drug spending. Why? Because they’re cheap. A 30-day supply of metformin, for example, costs $4 to $10 at the pharmacy - if your plan covers it properly. If you’re on three generic medications - say, lisinopril, levothyroxine, and atorvastatin - and your old plan charged $15 per pill, you’re spending $540 a year. Switch to a plan with a $3 copay? That’s $108 a year. That’s $432 saved. And that’s just for three pills. Silver Standardized Plans (SPDs) on the marketplace are especially good for generic users. They waive your deductible for Tier 1 drugs and cap copays at $20. That means even if you haven’t met your $3,000 medical deductible, your generic meds still cost $20. Non-standardized plans? You pay full price until you hit that deductible. For someone on regular meds, that’s a $1,500 to $5,000 annual difference.Medicare Part D and the Hidden Trap

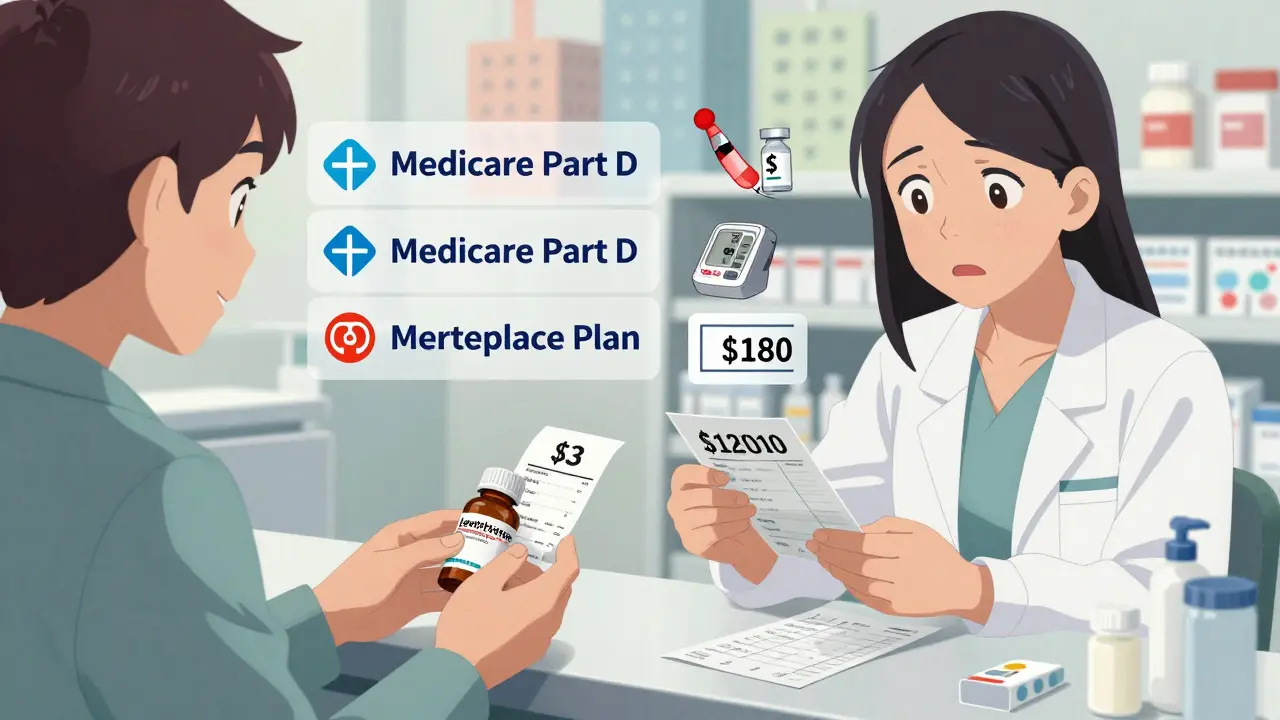

If you’re on Medicare, you’re probably looking at Part D or a Medicare Advantage plan with drug coverage. In 2023, the base deductible for Part D was $505. Most plans charge $0 to $10 for generics after you hit that deductible. Sounds fair, right? But here’s the problem: many people don’t realize their Medicare Advantage plan might have a different formulary than their old Part D plan. Your levothyroxine might be Tier 1 on Plan A - $0 copay. On Plan B, it’s Tier 2 - $25 copay. Same drug. Same manufacturer. But the plan changed the tier because of a contract with a pharmacy benefit manager. Medicare’s own data shows 15% of beneficiaries get hit with unexpected cost increases when switching plans - mostly because their generic meds moved to a higher tier. The most common culprits? Blood pressure, diabetes, and thyroid meds. These are drugs you take every day. A $15 increase per month adds up to $180 a year. Multiply that by three drugs? That’s $540 gone.

State Rules Change Everything

Where you live matters more than you think. California has a $85 outpatient drug deductible. After that, you pay 20% coinsurance - capped at $250 per year. New York? No deductible for generics. Just a $7 copay. DC has a separate $350 drug deductible, but caps specialty drug costs at $150. In New York, if you take three generics, you pay $21 a month. In California, you pay $85 in January, then 20% of the rest. That’s $1.60 for a $8 pill - so $4.80 a month. Sounds better? Maybe. But if your meds cost $20 each? You’re paying $12 a month after the deductible. Now you’re paying more than New Yorkers. And then there’s insulin. Thanks to the Inflation Reduction Act, insulin is capped at $35 a month for Medicare Part D users starting in 2023. California and New York already had $0 or $25 caps. But not all states do. If you’re switching plans and live in a state without insulin caps, you could pay $100+ a month - unless you pick a plan that includes it in Tier 1.The 4-Step Checklist to Avoid Cost Surprises

You don’t need to be a pharmacist to get this right. Just follow these four steps before you switch:- Get the full formulary - not just the summary. Look for your exact drug name and manufacturer. Metformin made by Teva might be Tier 1. Metformin made by Mylan might be Tier 2. They’re chemically identical. But the plan doesn’t care.

- Check your pharmacy network. Your $3 generic might be $12 if you go to a non-preferred pharmacy. OptumRx, CVS Caremark, and Express Scripts have their own lists. Use the plan’s pharmacy locator tool.

- Calculate your annual cost. Add up your monthly copays. Multiply by 12. Then add any deductible you might have to meet. Don’t assume you’ll hit the deductible - many people don’t. But if you do, you’ll pay more than expected.

- Use the official tools. Medicare.gov’s Plan Finder and Healthcare.gov’s plan selector have cost calculators built in. They let you plug in your drugs and see real estimates. CMS says users who use these tools reduce prescription complaints by 37%.

People who do all four steps cut their unexpected drug costs by 73%, according to CMS data. That’s not a small number. That’s life-changing money.

Common Mistakes People Make

Most mistakes are simple - and avoidable.- Assuming all generics are equal. They’re not. Formularies change based on manufacturer, not active ingredient.

- Ignoring mail-order vs. retail. Some plans charge $10 for a 30-day supply at CVS but $5 for a 90-day supply by mail. That’s $60 saved a year.

- Not checking for tier changes. UnitedHealthcare, Humana, and other big insurers change formularies every January. Your $3 drug could become $20 overnight.

- Forgetting specialty generics. Some generics - like those for rheumatoid arthritis or multiple sclerosis - are classified as specialty drugs. They’re Tier 4 or 5. Coinsurance can be 30%. That’s $150 for a $500 drug.

Reddit users reported 147 cases in 2023 where switching plans led to surprise costs - and 63% of them were because the generic manufacturer changed. One person switched plans and suddenly paid $180 a month for levothyroxine. Her old plan covered one brand. The new one didn’t. She had to switch pills. Her doctor had to retest her thyroid levels. It took three months to fix.

What’s Changing in 2025 and Beyond

The rules are shifting. Starting in 2025, Medicare Part D will cap out-of-pocket drug spending at $2,000 a year. That’s huge. But it also means plans will get more aggressive about managing costs - which could mean tighter formularies. More states are banning integrated medical and drug deductibles. California’s $85 drug deductible is already helping people stick to their meds. Experts predict 80% of marketplace plans will drop integrated deductibles by 2027 because people keep getting burned. AI tools like CMS’s new ‘Medicare Plan Scout’ are helping. In a pilot, it cut enrollment errors by 44%. These tools will get better. But they’re not perfect. You still need to double-check.Bottom Line: Don’t Guess. Verify.

Switching health plans isn’t just about premiums. It’s about what happens when you walk into the pharmacy. A $10 difference on your monthly pill can mean $120 a year. On three meds? $360. On five? $600. That’s a vacation. A car payment. A month’s rent. The cheapest plan isn’t always the best. The plan with the lowest monthly premium might charge you $500 extra for your prescriptions. Don’t be fooled. Take 30 minutes. Use the official tools. Print out your formulary. Call your pharmacist. Ask: “If I switch, will my meds cost more?” If they hesitate, you’ve got your answer.You don’t need to be an expert. You just need to be careful.

Are all generic drugs covered the same across health plans?

No. Even if two generics have the same active ingredient, they can be on different tiers based on the manufacturer, contract deals between insurers and pharmacy benefit managers, or whether the drug is preferred. One plan might cover metformin from Teva at $3, while another charges $20 for metformin from Mylan - even though they’re identical.

Do I have to meet my deductible before generic drugs are covered?

It depends. In Silver Standardized Plans on the marketplace, generics are covered with a fixed copay - even if you haven’t met your deductible. But in most other plans, including many high-deductible plans, you must pay the full deductible for medical and prescription costs before your plan starts covering anything. Always check the plan’s formulary details.

How do I know if my specific generic drug is covered?

Don’t just search by drug name. You need the exact brand name of the generic manufacturer (e.g., ‘metformin ER by Teva’). Use the plan’s official formulary search tool, not third-party websites. Many insurers have downloadable PDFs of their full formularies - look for those.

Can I switch to a different generic if mine isn’t covered?

Sometimes. But only if your doctor agrees. Many generics aren’t interchangeable without a new prescription. Switching from one manufacturer’s metformin to another might require a new script - and your doctor may need to test your blood levels again. Don’t assume you can just swap.

What should I do if my drug is moved to a higher tier after I switch?

Contact your insurer immediately. Ask for a formulary exception or appeal. Many plans allow exceptions for medically necessary drugs, especially if you’ve been on them for years. You can also ask your doctor to prescribe a different generic that’s covered - but make sure it’s safe and effective first.

Are mail-order pharmacies better for generic drugs?

Often yes. Many plans charge less for 90-day supplies through mail-order pharmacies. For example, a $10 copay for 30 days becomes $25 for 90 days - saving you $5 a month. But check if your pharmacy is in-network. Using an out-of-network mail-order service can cost 300-400% more.

Next Steps: What to Do Today

If you’re thinking about switching plans:- Write down every medication you take - including dosage and manufacturer.

- Go to Healthcare.gov or Medicare.gov and use their plan comparison tools.

- Enter your drugs. Compare the estimated annual cost for each plan.

- Print the results. Bring them to your doctor or pharmacist for a second opinion.

- Don’t wait until open enrollment. Start now. Changes can take weeks to process.

One phone call to your insurer - asking for your formulary - could save you hundreds. Don’t let a paperwork oversight cost you money you can’t afford to lose.

10 Comments

anthony martinez

January 11, 2026 AT 06:33So let me get this straight - I pay $500 a month for a plan that charges $20 for metformin, but if I switch to the $300 plan, I pay $180 for the same pill? And the only way to know is to dig through a 47-page PDF that changes every January? Thanks for the life advice, I guess.

Michael Marchio

January 13, 2026 AT 05:39You’re all missing the bigger picture. The entire system is rigged. Pharmacy benefit managers (PBMs) are the real villains here - they negotiate secret rebates with drug manufacturers, and the savings never reach you. They push higher-tier drugs because they get kickbacks, and your doctor doesn’t even know. That’s why your levothyroxine suddenly costs $180 - not because of your plan, but because the PBM swapped the contract. This isn’t about formularies. It’s about corporate greed disguised as healthcare.

And don’t get me started on how Medicare Part D allows PBMs to dictate formularies while patients get stuck paying the difference. The government claims it’s protecting seniors, but it’s just outsourcing the exploitation. You think you’re saving money? You’re just being funneled into a different trap.

And yes, I’ve seen it happen. A friend’s insulin went from $30 to $120 overnight because the PBM changed the preferred manufacturer. No warning. No appeal process. Just a letter from CVS Caremark saying ‘we’ve updated your formulary.’ That’s not healthcare. That’s a bait-and-switch with a stethoscope.

Until we break the PBM monopoly and force transparency on rebate structures, none of your checklists matter. You’re just rearranging deck chairs on the Titanic.

neeraj maor

January 13, 2026 AT 13:50Did you know that 89% of generic drugs sold in the U.S. are manufactured in India and China? And that the FDA inspects less than 3% of these facilities annually? So when your plan switches from Teva to Mylan, you’re not just getting a different brand - you’re getting a different factory, possibly with different quality controls. The active ingredient is the same, sure - but the fillers? The binders? The coating? Those can affect absorption. And no one tests that. Not even your pharmacist.

And then there’s the black market. There are reports of counterfeit metformin entering the supply chain - fake pills with no active ingredient. They’re sold through unregulated mail-order pharmacies. And guess what? Some insurance plans push you toward those because they’re cheaper. So your $5 mail-order script? Might be sugar pills. Your thyroid levels crash. You end up in the ER. And the plan says, ‘We covered the drug. Not your health.’

So yes, check your formulary. But also ask: Who made this? Where? And what’s the audit trail? If they can’t answer, you’re playing Russian roulette with your meds.

Ritwik Bose

January 14, 2026 AT 21:57Thank you for this incredibly detailed and thoughtful breakdown. 🙏 I’ve been navigating this system for my mother, who is on Medicare, and your 4-step checklist is now printed and taped to her fridge. I especially appreciate the note about manufacturer differences - we didn’t realize that ‘metformin’ could mean two entirely different experiences. I’ve also reached out to our pharmacist, who confirmed that the plan’s mail-order option saves us $70/month. Small wins, but they matter. I’m so grateful for clear, compassionate guidance in a system that often feels designed to confuse.

Paul Bear

January 14, 2026 AT 22:47Let’s be precise here. The Affordable Care Act mandated a 4-tier formulary structure for marketplace plans, but it did not standardize copay amounts, deductible thresholds, or manufacturer preferences - all of which are governed by individual plan contracts with PBMs under the ERISA framework. Therefore, the variance you observe is not a regulatory failure, but a contractual one. The CMS tools you recommend are compliant with 45 CFR §156.220, which requires cost transparency, but they are not binding on plan sponsors.

Furthermore, the notion that ‘all generics are equal’ is pharmacologically inaccurate. Bioequivalence is defined as 80–125% of the reference drug’s AUC and Cmax, meaning a 25% variance is legally permissible. Some patients experience clinical differences - especially with narrow-therapeutic-index drugs like levothyroxine - which is why many endocrinologists recommend brand consistency. This is not a flaw in the system. It’s a feature of pharmacokinetics.

So yes, verify your formulary. But also verify your physician’s prescribing intent. And if your doctor is unaware of bioequivalence thresholds, they’re not providing optimal care.

lisa Bajram

January 16, 2026 AT 11:29OH MY GOSH, YES!! I just switched plans last month and almost cried when my $3 lisinopril jumped to $47 - I thought I was going to lose my house!! 😭 But I followed your checklist - printed the formulary, called my pharmacist, and found out they were using a different manufacturer. I asked my doctor to switch me to the covered one - and guess what? It worked! Now I’m paying $5 and I’m not stressed out every time I walk into the pharmacy. You’re right - it’s not about the plan’s price tag, it’s about the pill in your hand. Do the work. It’s worth it. You got this!! 💪💖

Jaqueline santos bau

January 17, 2026 AT 19:51Wait - so you’re telling me my $200/month plan is actually worse than my $400 plan because the $400 one covers my thyroid med? That’s insane. I’ve been paying $120 a month for my meds on the ‘cheap’ plan and I thought I was being smart. Now I’m mad. Like, ‘I’m going to post this on LinkedIn and tag my senator’ mad. Who designed this system? A robot? A demon? My cousin’s insurance did the same thing - she had to stop taking her diabetes meds for two months because she couldn’t afford it. And now she’s in the hospital. This isn’t healthcare. This is a horror story with a deductible.

Kunal Majumder

January 18, 2026 AT 09:25Bro, I was in your shoes last year. Took me 3 weeks to figure it out, but once I used Medicare’s Plan Finder and typed in my exact meds - including ‘Teva’ and ‘Mylan’ - it lit up like a Christmas tree. Saved me $500 a year. Just don’t trust the ads. Go straight to the source. And if you’re on insulin? Always check the cap. Some plans lie about it. Call them. Ask: ‘Is my insulin covered under the $35 cap?’ If they say ‘maybe,’ they’re lying.

Aurora Memo

January 19, 2026 AT 09:39This is such an important topic. I’ve worked with patients who skip doses because they can’t afford their meds - and it leads to hospitalizations that cost far more than the drugs ever would. The fact that we have to be detectives just to get basic care is heartbreaking. I encourage everyone to print their formulary, keep it in their wallet, and bring it to every doctor’s visit. You’re not being difficult - you’re being your own best advocate. Small steps, but they save lives.

chandra tan

January 21, 2026 AT 07:33From India, I’ve seen how generic drugs are made - and it’s not all bad. But I also know how supply chains get twisted. If your plan switches to a cheaper generic, it might be fine - or it might be from a factory with no QA. I don’t trust the system, but I trust the checklist. Use it. And if you’re in the US, tell your reps: fix the PBM mess. We’re not asking for luxury. Just consistent, safe, affordable meds.